DHAKA—In August, Bangladeshi police broke up a ring of human organ dealers operating in Joypurhat, a district in the north of the country. Investigators say that three local “brokers” preyed on a large pool of indebted farmers, who agreed to part with a kidney or a chunk of their liver for a couple thousand dollars—enough for them to pay down their debts. Mosammat Rebeca and her husband sold their kidneys to help pay back 180,000 taka ($2,358) owed to five separate lenders—a massive sum in a country where the per capita annual income hovers around $1,700. Rebeca’s husband was paid 135,000 taka ($1,768) for selling his kidney last year, but it wasn’t quite enough. “We were about 65,000 taka short, so I had to donate my kidney as well,” she told me in a recent interview.

DHAKA—In August, Bangladeshi police broke up a ring of human organ dealers operating in Joypurhat, a district in the north of the country. Investigators say that three local “brokers” preyed on a large pool of indebted farmers, who agreed to part with a kidney or a chunk of their liver for a couple thousand dollars—enough for them to pay down their debts. Mosammat Rebeca and her husband sold their kidneys to help pay back 180,000 taka ($2,358) owed to five separate lenders—a massive sum in a country where the per capita annual income hovers around $1,700. Rebeca’s husband was paid 135,000 taka ($1,768) for selling his kidney last year, but it wasn’t quite enough. “We were about 65,000 taka short, so I had to donate my kidney as well,” she told me in a recent interview.

Rural indebtedness is as old as the earth in South Asia, but what was notable in this case was its source. Instead of the usurious village moneylenders of old, many organ sellers say they were victims of a new, apparently virtuous, engine of economic empowerment—microfinance. While such micro-loan programs have been widely touted as a ladder out of poverty, they had become a crushing burden for many in Joypurhat, who spoke to me of entangling webs of debt and the aggressive tactics of NGO debt collectors. Indeed, stories like the ones I heard in Bangladesh speak to a larger backlash, both on the ground and in the academy, against the practice of offering micro-loans as a tool for international development. While the majority of microcredit institutions are doubtless well-intentioned, in many places an unregulated and overzealous lending market has led to rashes of personal indebtedness and desperation that are a far cry from the development outcomes originally envisioned by experts and donors.

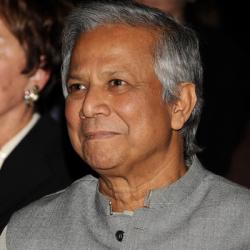

THE PRACTICE OF OFFERING micro-loans as a tool for poverty alleviation has a long and multifaceted history, but most popular accounts begin with Mohammad Yunus’s decision to establish the Grameen Bank in 1976, handing out small loans to impoverished households in rural Bangladesh. In the view of Yunus and other early boosters, access to credit was directly linked to poverty reduction: Granting access to funds at reasonable interest rates would allow the poor to avoid the usurious rates of traditional moneylenders and use the funds to start small businesses and cottage enterprises. In addition, one of Grameen’s key innovations was to target its financial services at women, who bear a disproportionate burden of poverty and are thought to be more reliable financial clients than men. Given the chance, Yunus came to believe, Bangladesh’s rural women could form self-reinforcing networks of trust that would guard against defaults. In short, the poor could be made “bankable.”

Since then, microfinance institutions (MFIs) have revolutionized the field of development, and the global clients of these organizations number in the hundreds of millions. From a narrow focus on credit, MFIs have expanded to encompass a wide range of “micro” financial services, including savings accounts, insurance policies, and skills training programs. Yunus’s Grameen Bank has become an institutional behemoth supporting MFI operations on three continents and hawking everything from mobile phones and knitwear to software and business development plans. In awarding the 2006 Nobel Peace Prize to Yunus and Grameen, the Nobel committee stated that the bank had become “a source of ideas and models for the many institutions in the field of micro-credit that have sprung up around the world.”

But in recent years, microfinance has developed a macro-image problem. Anger has exploded in Andhra Pradesh, India, where journalists and politicians have linked MFIs, including SKS Microfinance, one of India’s largest, to dozens of rural suicides. Opposition came to a head there in October of 2010, when the state government approved an ordinance designed to prevent the “harassment” of small borrowers by debt collectors. Caught in Micro debt, a 2010 documentary by Norwegian journalist Tom Heinemann, turned the spotlight on Yunus and the Grameen Bank, accusing the Nobel laureate of tax evasion—an allegation that was partly used to justify Yunus’ removal as head of Grameen by the Bangladeshi government in March. (Yunus and his supporters deny the film’s allegations.)

Bangladeshi critics say that MFIs have simply acquired too much power and made far too many irresponsible loans, constituting an unregulated shadow state within the country which, far from alleviating poverty, has worsened the situation of the rural poor. “Microcredit is discrimination against the poor, it doesn’t empower. It’s total nonsense,” said Farhad Mazhar, the managing director of UBINIG, a Dhaka-based alternative development organization. According to unpublished research conducted by UBINIG, only around 8 percent of the micro-borrowers surveyed ended up using their loans to build wealth. Even then, Mazhar said, individual success owed more to pre-existing entrepreneurial skills and family support than to the credit itself. “Most of them became poorer,” Mazhar contends.

Skepticism of microfinance and its benefits, meanwhile, has migrated to the academy as well. Lamia Karim, an anthropologist at the University of Oregon and the author of Microfinance and Its Discontents, has questioned the claim that offering small loans directly to Bangladeshi women has been empowering. On the contrary, she has found women are often pressured to hand over loans to their husbands or male relatives. At the same time, microcredit agencies have created what she terms an “economy of shame,” in which the traditional role of women as bearers of “family honor” is used to leverage repayments—a key yardstick of MFIs’ success. (Grameen, for instance, proudly trumpets a loan recovery rate of close to 97 percent). To avoid the public shame of default, many women take out additional loans from different lenders, and quickly find themselves mired in a quicksand of debt.

A heavy emphasis on measuring loan recovery rates also tends to obscure whether borrowers are actually using the loans for productive activities, as opposed to mere survival. When it comes to quantifying the latter variable, one recent report commissioned by the United Kingdom’s Department for International Development and released in August concluded that “almost all impact evaluations of microfinance suffer from weak methodologies and inadequate data.” Given this vacuum of quality research, Maren Duvendack, a research fellow at the University of East Anglia and one of the report’s authors, says the verdict on microfinance is still out. “I’m surprised microfinance has been hyped up so much,” she told me, “because good impact evaluations are still pretty scarce.”

This dearth of evidence can be explained partly by the challenges researchers face in isolating the effects of microfinance operations, but it also demonstrates a tendency for international donors to see what they wanted to see. Indeed, microfinance has a seductive logic on paper: Unlike the older “hand-out” model of international development, MFIs promised to be self-sustaining engines of micro-development, and Yunus—an urbane globetrotter backed by a strong lobby of international supporters—was the perfect salesman. “People were looking for some sort of silver bullet that alleviates poverty and empowers women, and they thought credit was the answer,” Duvendack said.

The ensuing explosion of popularity has arguably pushed aside developmental alternatives, including programs to boost agricultural productivity and skills training, that could have contributed to the fight against poverty. While admitting that access to credit is a handy tool, Mazhar of UBINIG argues that microfinance had been elevated into a shibboleth of market-based theories of development that encourages the withdrawal of the state from rural development in favor of the “village entrepreneur.” Taken on their own, MFIs have failed to alter the feudal economic structures in rural Bangladesh, something that can only be achieved by boosting agricultural productivity. “The machine that produces the poverty—you’re not trying to change it,” Mazhar said.

BUT IF MICROFINANCE has doubtless been oversold, other experts say the growing backlash is in danger of overcorrecting. Dean Karlan, an economist at Yale and the author of More Than Good Intentions: How a New Economics Is Helping to Solve Global Poverty, observed that much of the opposition has stemmed from an “irrational exuberance” about the importance of credit, but that microfinance can still offer the poor a range of valuable economic tools. In the course of his research, for instance, Karlan said many low-income clients had shown a strong interest in micro-savings accounts. “The fact is not everybody always needs a loan,” he said. “The microfinance community needs to be more client-focused, so to speak, and more focused on what people actually need.” The negative impacts of credit, meanwhile, could be partly ameliorated by giving micro-borrowers a means of taking action against over-zealous debt collectors, or establishing credit bureaus so lenders can prevent the poor from taking on too much debt. “The right answer is not to shut down the market,” Karlan said.

Of course, this won’t satisfy farmers in Joypurhat who sold their body parts to pay down mountains of micro-debt, but it does demonstrate a strong role for the state as an overseer and regulator of rural credit markets. Simply expecting that the invisible hands of microfinance will elevate the poor without outside safeguards is to court further misfortunes for those who can least afford them. Microfinance services should be part of a balanced diet of development, one that incorporates skills training and agricultural strategies. In this sense, the backlash might actually be a good thing for the industry, helping sheer away some of the exuberance that has led to such negative outcomes. Provided that the lessons of overreach are internalized, there’s even some reason to be cautiously optimistic. “It does work in certain contexts for certain people,” Duvendack said of microfinance, “and maybe that’s good enough.”

[Published by The New Republic, December 14, 2011]